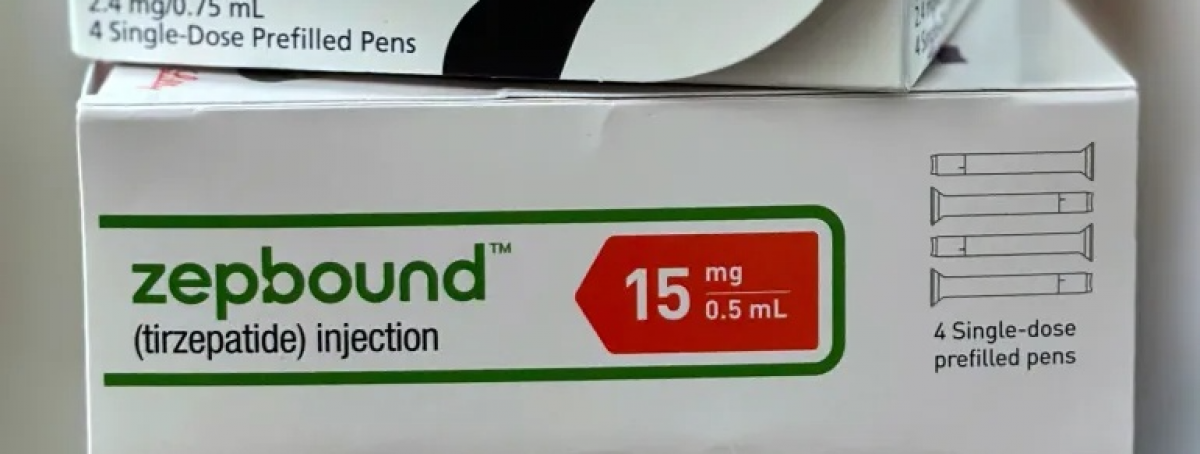

Eli Lilly has become the first pharmaceutical company to cross the one trillion dollar valuation mark, propelled by a dramatic expansion of the global weight loss drug market. A rally of more than 35 per cent this year reflects surging demand for its flagship treatments, Mounjaro and Zepbound, which have overtaken early rival Novo Nordisk in prescriptions. The achievement places Lilly in a valuation tier previously dominated by technology giants.

The company now trades at one of the highest multiples in the sector at around 50 times expected earnings, underscoring investor confidence in long term demand for GLP-1 therapies. Shares have risen more than 75 per cent since Zepbound’s launch in late 2023, far outperforming the broader United States equity market. In its most recent quarter, the firm generated more than half of its 17.6 billion dollar revenue from its obesity and diabetes portfolio alone.

The market for weight loss drugs is projected to hit 150 billion dollars by 2030, with Lilly and Novo Nordisk expected to dominate global sales. Analysts highlight the upcoming approval of Lilly’s oral obesity drug, orforglipron, as a pivotal moment that could accelerate momentum and deepen its competitive advantage. The company’s recent pricing agreement with the White House and ongoing investments to expand production capacity further strengthen its growth outlook.

Commentators note that Lilly is beginning to mirror the market influence of the so called Magnificent Seven, with some investors viewing it as a potential alternative amid volatility in certain AI stocks. Still, sustaining this trajectory will depend on whether Lilly can navigate pricing pressures, scale manufacturing efficiently and maintain the performance of its wider pipeline.

Dive deeper into the implications of Lilly’s trillion dollar ascent by reading the full article.

.png)